By Nina Wilkinson

Why companies must link sustainability goals to tangible financial returns.

Age of ESG Backlash

A wave of opposition towards ESG – environmental, social and governance – has swelled and garnered attention amidst a changing political landscape. In January, returning US President Trump made swift moves to withdraw his support for climate policy and diversity, inclusion and equity (DEI) initiatives. In reaction, a chorus of corporates, including Citigroup1 and PepsiCo2, announced a wind back of their own DEI agendas. Many are asking what this means for Australian corporates and whether we are seeing a step back from ESG initiatives locally ?

We believe that greater scrutiny is helpful and can lead to better outcomes. For starters, less of a box-ticking mindset, and more of a focus towards material, dial-turning ESG initiatives is important. Ensuring companies are not “Greenwashing” – exaggerating or falsely declaring environmentally friendly credentials – is also a critical step in establishing greater investor and consumer confidence in ESG.

We view progress such as the mandatory climate reporting standards, rolled out in 2025 for large companies, as a positive development in Australia. Requiring ASX directors to sign off on emissions targets, scrutinising and validating the assumptions, provides important rigour to statements. It also connects directors to their fiduciary duty of care and diligence to foreseeable risks such as climate change that have a material impact on their business.

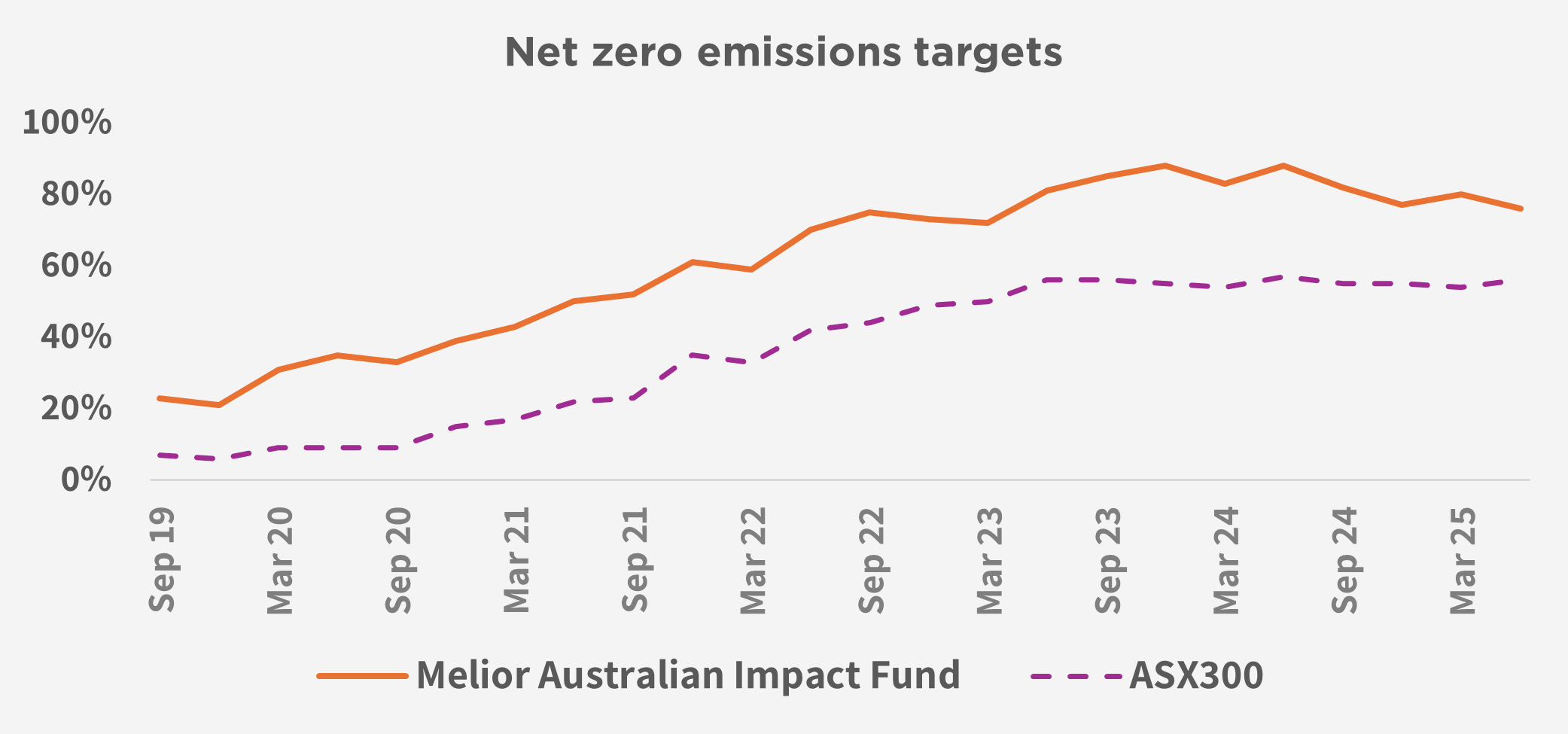

Melior’s data shows that the proportion of ASX 300 companies with net zero emissions targets has stagnated for the past two years and declined from 57% to 56% over the 12 months to 30 June 2025, possibly an indication of the higher scrutiny these targets are receiving internally and externally.

Source: Melior

But What Does Sustainability Actually Mean?

The idea of corporate values has always been a nebulous one. Language can be weaponised; “woke” has become a loaded word. ESG began as a clunky concept and is now on the verge of being cancelled, undermining years of progress. However, sustainability – or the ability to be maintained at a certain rate or level – is a notion which connects directly to fundamental financial principles. Following this logic, a valuable company is one that can maintain strong returns on capital over time amidst uncertainty and change. One that can maintain profitability in the face of depleting natural resources and evolving societal views, holding on to their ‘social licence to operate’.

Connecting Values to Value

We believe the case for sustainability is clear, but ESG needs to connect values to value. Before “ESG” became a weaponised term, its underlying concepts were already part of any credible financial analysis. Board quality, safety record, environmental regulation, supply chain dependencies; these are all risks that could impact a company’s reputation, risk of litigation, risk of negative regulatory outcomes, cost of capital, ability to hire and ability to sell their products.

Companies should not abandon ESG but address the “woke smoke” and reinforce their ambition by linking sustainability practices to tangible financial and business outcomes. This enhances staff buy-in as well as customer and investor credibility. It is an opportunity to articulate a clear rationale behind goals which are often long-dated and non-linear.

Justifying to stakeholders – including all shareholders, not just ESG teams who often sit on the peripheral of investment teams – what payoffs are expected to be generated from ESG objectives, is critical. Then all investors can understand and share in value creation; or at least make informed decisions whether they agree with management strategy based on tangible information.

Whilst value is subjective, it is not impossible to assess. Accountants and financial markets have long grappled every day with how to measure the value of brands, intellectual property, and managerial know-how. Deloitte found that intangible assets contribute 57% of the value of the ASX 100, and circa 89% of the NASDAQ3 (driven by a heavy representation of Tech companies in the latter index), highlighting the importance of intangible assets which are often significantly influenced by ESG characteristics and events.

Companies Leading the Charge

Sustainability poster-child Patagonia has built a successful brand almost entirely off the back of its environmental credentials, but other vocal corporate leaders are hard to find. Several companies have called out lower costs from carbon reduction initiatives – including Intel who derived a cumulative cost savings of ~USD118m from USD96m invested in energy conservation projects since 20204. Others including Salesforce5 cite employee retention and productivity benefits from diverse recruitment and workforce inclusion policies. Recent defenders of their company’s commitment to DEI include Apple6 and Microsoft7.

Not surprisingly, European companies are further along the curve. Nestle’s Creating Shared Value8 strategy identifies material impacts, risks and opportunities so that stakeholders understand ramifications of action or inaction. France’s Schneider Electric aims to capture lucrative revenues9 from clients electrifying their businesses, driving product innovation and capturing market share.

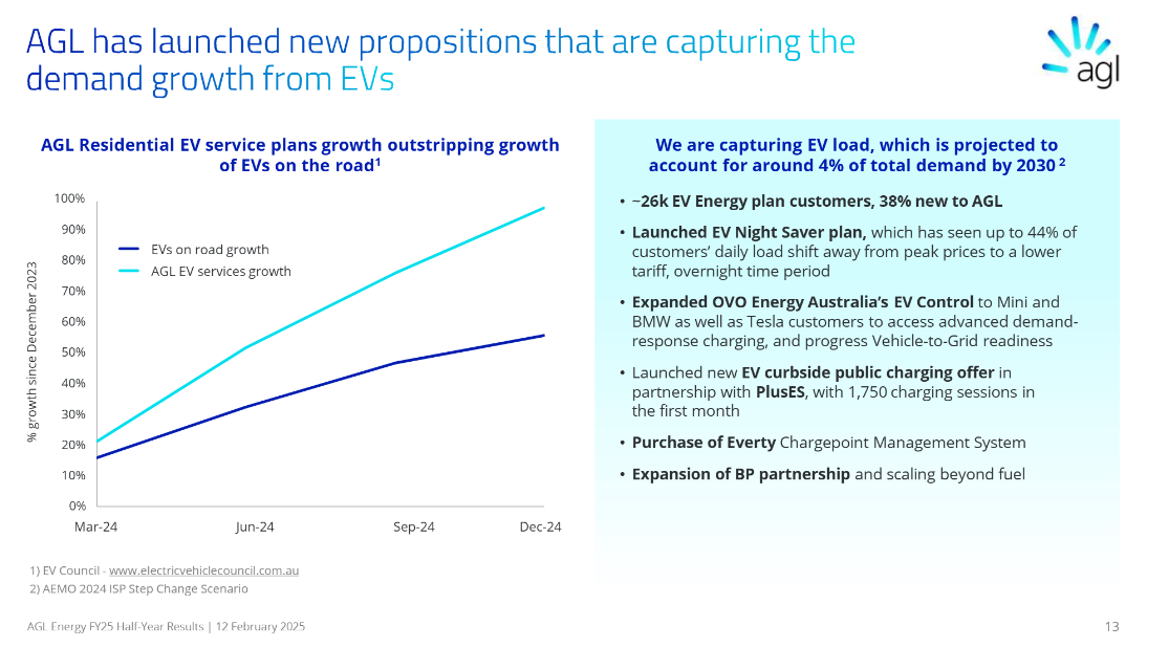

In Australia, we are also seeing examples of values connecting to value emerging. Australia’s largest corporate emitter of greenhouse gases, AGL, faced a crossroads to ensure the company’s survival by decarbonising energy supply and transitioning its assets from fossil fuels to renewables. It’s still early days, but already the company has grown its ‘green’ revenues (e.g. carbon neutral products) by 83% over 5 years and uncovered new pockets of demand; its specialised EV Night Saver plan is capturing market share and balancing electricity load towards off-peak10. Encouragingly, AGL’s “Business Value Drivers” framework11 sets out how its purpose, values and strategy drive financial value.

Melior's Approach

Our investment beliefs were never grounded in ideology or a political stance. As stewards of long-term capital for our investors, we believe investing in positive impact companies with strong ESG and financial characteristics will deliver share price outperformance over the long term.

Our philosophy is also built on the belief that actively engaging companies on material sustainability areas can bring forward impact and ESG improvements that help deliver better company outcomes and share price performance potential. This is a key reason why Melior has been built intentionally with an investment team of financial analysts who integrate impact and ESG factors into their fundamental research. We generate unique insights and our engagement with boards and management teams is unique too, connecting values to value.

Having a team of financial analysts with expertise in sustainability has also meant we can critically assess the value and approach of membership groups. For instance, we have avoided joining several coalitions which we feared were not fit for purpose.

Conclusion

As the name suggests, we believe sustainability is here to stay. ESG however needs to evolve to connect values with value and that the investment community can help drive this by integrating ESG and fundamental analysis. We see the recent pendulum swing as an opportunity for investors and corporates to double down and do ESG properly – by putting their money where their mouth is.

Sources

1. https://www.citigroup.com/global/news/perspective/2025/022025-jane-fraser-statement

2. https://www.reuters.com/business/retail-consumer/pepsico-joins-major-us-companies-tweaking-dei-policies-2025-02-20/

3. Intangible value contribution to the ASX 100

4. 2023-24 Intel Corporate Responsibility Report, page 73

5. https://www.salesforce.com/au/news/stories/annual-equality-update-2024/

6. https://aboutblaw.com/bgVS

7. https://www.linkedin.com/pulse/doing-work-intention-inclusion-impact-lindsay-rae-mcintyre-cvg4c/?trackingId=jxz3zz9JQAqhm4XiO92yfw%3D%3D

8. https://www.nestle.com/sites/default/files/2025-02/non-financial-statement-2024.pdf

9. https://www.nestle.com/sites/default/files/2025-02/creating-shared-value-nestle-2024.pdf

10. https://www.se.com/ww/en/assets/564/document/463535/Integrated-report-2023.pdf?p_enDocType=Financial%20release&p_File_Name=Integrated%20report%202023

11. https://www.se.com/ww/en/assets/564/document/466155/2023-sustainability-report.pdf?p_enDocType=EDMS&p_File_Name=2023%20Sustainable%20Development%20Report

12. AGL 1H25 results presentation, page 13 https://www.agl.com.au/content/dam/digital/agl/documents/about-agl/news-centre/2025/250212-2025-half-year-results-presentation.pdf

13. AGL FY24 Annual Report, page 4, https://www.agl.com.au/content/dam/digital/agl/documents/about-agl/investors/2024/240814-2024–annual-report.pdf

This Report is issued by The Trust Company (RE Services) Limited (ABN 45 003 278 831, AFSL No. 235150) as Responsible Entity and issuer of units in the Melior Australian Impact Fund, based on information prepared and collated by Melior Investment Management Pty Limited (Melior). Melior is a Corporate Authorised Representative (No. 001274055) of Adamantem Capital Pty Limited (ACN 614 857 037, AFSL No. 492717). It is general information only and is not intended to provide you with financial advice, and has been prepared without taking into account your objectives, financial situation or needs. You should consider the product disclosure statement (PDS), prior to making any investment decisions. The PDS and target market determination (TMD) can be obtained by calling +61 2 9004 6071 or visiting our website www. meliorim.com.au. If you require financial advice that takes into account your personal objectives, financial situation or needs, you should consult your licensed or authorised financial adviser. To the extent permitted by law, no liability is accepted for any loss or damage as a result of any reliance on this information. No company in the Perpetual Group (Perpetual Limited ABN 86 000 431 827 and its subsidiaries) guarantees the performance of any fund or the return of an investor’s capital. Total returns shown for the Fund have been calculated using exit prices after taking into account all ongoing fees and assuming reinvestment of distributions. No allowance has been made for taxation. Past performance is not indicative of future performance. Listed equities markets can experience volatility, particularly in the short term. Investments in listed equities markets are therefore generally classified as higher risk than other asset classes such as fixed income and cash. As the Fund invests most of its assets in Australian listed equities, it should be considered a high risk investment. Please refer to the PDS for details of the types of risks which are associated with investing in the Fund.