By Abi High

As Artificial Intelligence (AI) continues to revolutionise businesses across the globe, it is recorded that 64% of businesses expect AI to increase productivity1. To unlock sustainable shareholder value offered by increased adoption, we must consider both the risks and rewards that AI presents.

What is AI and Why Now?

“In its most fundamental form, AI is the capability of a computer program or a machine to think and learn and take actions without being explicitly encoded with commands. AI can be thought of as the development of computer systems that can perform tasks autonomously, ingesting and analyzing enormous volumes of data, then recognizing patterns in that data.” (Nvidia2). Generative AI refers to deep-learning models that can generate new content such as high-quality text and images based on the data they were trained on3.

While the notion of AI was conceptualised as early as the 1950s4, its recent rise to prominence is largely due to both global data proliferation and the opening of public access to AI technologies, via open-source large language models5 such as Chat GPT.

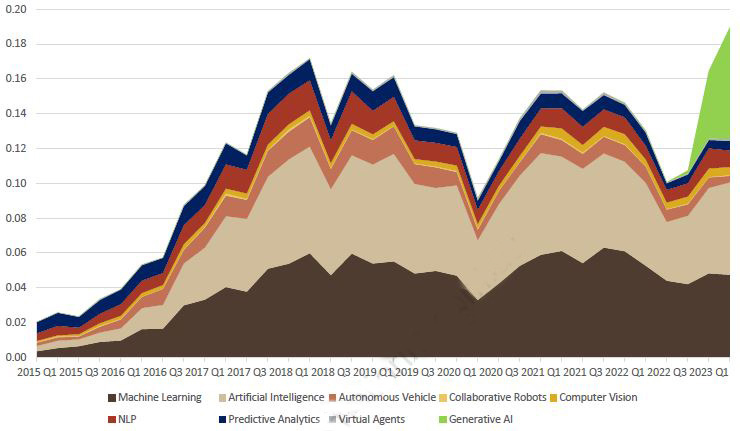

The potential for AI to drive significant shareholder value has made it a hot topic amongst the investment community given its strong growth (see Figure 1 below). However, we should be aware of the risks as well as the rewards that this technology brings and be careful not to confuse AI and generative AI with traditional technology enhancements such as automation.

Figure 1: Proportion of transcripts containing a reference to artificial intelligence

Source: UBS, ‘Will Generative AI deliver a generational transformation?, 26 May 2023

Investment Opportunities

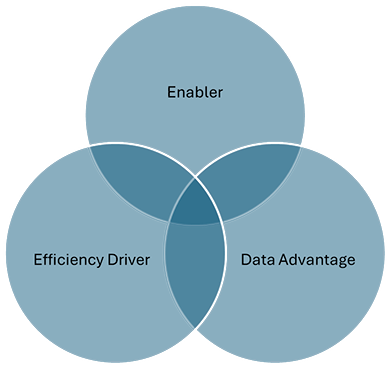

Melior believes that companies could benefit from the AI revolution in three principle ways; As an enabler, an efficiency driver, or through data advantage.

Each of these groups of companies will benefit from the move to AI in a different way, but each has the potential to drive shareholder value by the widespread adoption of the technology.

- Enabler. These companies have a revenue opportunity from the pickup in AI demand. These are the companies that facilitate the implementation of AI technologies, for example network operators, data centres, manufacturers of high-performance hardware or software developers exposed to model training or security.

- Efficiency driver. These companies have a cost-out opportunity from implementing AI systems internally, meaning that they can eliminate costs throughout their supply chains. Many of these businesses will be labour-intensive and have the opportunity to reallocate their workforce into more skilled / value-add positions by using AI technology to conduct repetitive or specific tasks. Others may use AI technologies to become more efficient or effective in their roles. For example, healthcare imaging companies are exploring ways in which they can use AI models to do initial screening or enhanced reporting to support time-pressured radiologists to report images.

- Data advantage. These companies could have a valuable asset in the data they have generated over time, either by using this data internally (to drive efficiencies and focus resources on the most profitable departments) or selling the data externally to a third party. Companies in the retail sector for example have extensive data on consumer spending patterns, or healthcare companies that have accumulated significant amounts of data that could support their research.

Environmental Considerations

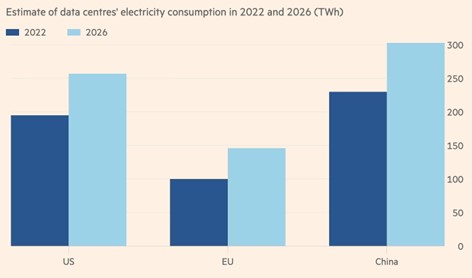

AI requires a huge amount of data storage to enable effective training and inference of large language models, thus adding to the growing demands on energy intensive data centres. While many headline-grabbing stats have been published about the ‘entire countries’ electricity demand that AI will consume6, or allegations that a ’ChatGPT query needs nearly 10 times as much electricity to process as a Google search’7 – assumptions and context are important.

The energy efficiency of each DC (Data Centre) will differ by location and operator, but data centres are invariably more energy efficient than the alternative of distributed computing, where Information Communication Technology (ICT) is stored in individual server rooms within the same building as the organisation that relies on them8. Moving IT load into a common location allows for centralised cooling and better efficiency of the electricity being drawn from the grid. With the shift towards AI gaining momentum, we should also consider the emissions saved from inefficient processes that will offset some of the higher energy intensity of LLM (Large Language Model) training and inference.

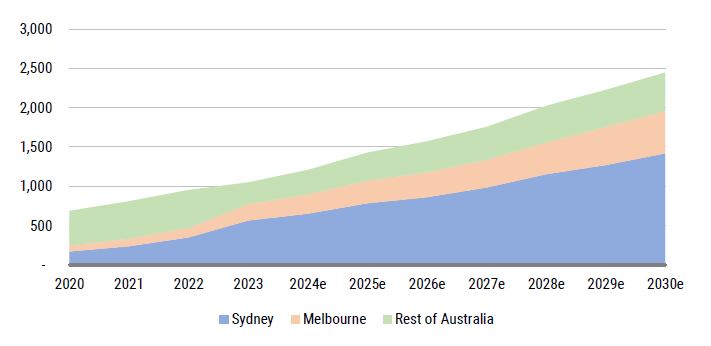

Figure 2: Data centres’ energy needs are set to rise sharply in key regions

Source: International Energy Agency

Currently in Australia, it is estimated that 5%9 of national electricity is consumed by the data centre industry (forecast to grow to 8% by 203010). While manageable at current levels, lessons from overseas have encouraged regulators and policymakers to intervene early to manage competing electricity requirements from the national grid. For example, in Ireland the data centre market is expected to account for 32% of national electricity demand by 2026. Regulators have responded by imposing restrictions on the building of new data centres in recent years (similar to what we have seen in Singapore, Germany, China and the US). Given the growth forecast for DC operators (Figure 2), we expect regulators and utility providers to continue to distinguish between more and less power-intensive DC operators in the approval of power permits. As well as tracking Scope 1, 2 & 3 emissions, PUE (Power Usage Effectiveness) is another metric often discussed in the industry in order to track and compare power efficiency. As well as regulatory and competitive pressures forcing data centre operators to reduce the carbon intensity of their data centres (via electricity usage), increasing media focus means that operators must also address this issue to maintain their social license to operate.

Figure 3: AU data centre market estimated to grow to ~2,500MW by 2030 up from ~1,050 today

Source: Morgan Stanley Research (e) estimates

Social Considerations

In assessing the impact that AI will have on a business model, we also need to consider the social risks. The human capital displacement from AI is a key social risk. Ensuring companies have retraining response plans in place to enable displacement risk to also be reframed as an opportunity that can retain talent and reduce recruitment costs is important.

Another social risk is the potential for AI to perpetuate biases and discrimination in our systems given the algorithms are based on the data they are trained on, which may be biased. An example of where this occurred was Amazon, which used an algorithm to help with its hiring process11. The algorithm was trained on historical hiring data that showed a bias towards men over women. As a result, the algorithm disproportionately picked men for new roles, perpetuating the existing gender bias. Companies need to ensure they are conscious of any potential data biases to help mitigate this risk.

Privacy is another social risk that needs to be managed. The Privacy Act in Australia protects individuals against many of the personal information concerns raised by implementation of AI but companies need to adopt their own policies and principles to manage privacy and other issues as outlined in the Governance section below.

Governance Considerations

Given the rapid adoption of AI technology, regulation has lagged uptake in many countries around the world, with the EU the first to establish a dedicated Artificial Intelligence Act this year. We should consider each companies’ adoption against Responsible AI principles. The Department of Industry, Science and Resources published a set of AI Ethics Principes in 201912 which are useful in considering the factors that companies should be assessing as they adopt AI, e.g. accountability for and transparency of AI-based systems. We also endeavour to understand the broader implications for companies adopting AI including managing cyber and intellectual property risks.

AI Opportunities and Risks - Melior Response

Melior seeks to invest in companies that contribute to the Sustainable Development Goals (SDGs). This is assessed in step 1 of our investment process, our Impact Assessment. Some of the companies that contribute positively to the SDGs, are also beneficiaries of increased AI adoption as an Enabler, an Efficiency Driver or given their Data Advantage.

Some examples of companies benefiting from AI that we invest in (as at August, 2024) are outlined below:

Enabler: NextDC (NXT)

NextDC build and operate co-location data centres in cities across Australia. NXT has been held in the portfolio since 2021 and is an ‘Enabler’ of AI; It has an increased revenue potential as a result of higher storage requirements and AI workloads within their data centres.

Efficiency Driver: Xero (XRO)

Xero is a leading global cloud-based accounting software platform. XRO is also held in the portfolio and is classified by Melior as an ‘Efficiency Driver’. As well as being integrated into their software solutions to replace repetitive and time-consuming tasks, AI technology is being used to power ‘JAX’ (Just Ask Xero) – their new Gen AI solution for small businesses and advisors – to help them more quickly and efficiently troubleshoot or complete.

Data Advantage: Sonic Healthcare (SHL)

Sonic Healthcare is a global healthcare provider with specialist operations in laboratory medicine / pathology, radiology, general practice medicine and corporate medical services. SHL is an example of a company that is developing a data advantage through use of AI in its operations. The healthcare system globally is facing increasing pressures that require technological improvements to allow pathologists to scale diagnostic technology and improve the quality of care. In June 2022, SHL launched Franklin.ai in collaboration with Harrison.ai, a platform which integrates AI with SHL’s deep clinical expertise and global reach. Franklin.ai aims to support a more efficient and effective diagnosis of patients by providing pathologists with a suite of AI solutions that can act as a second set of eyes, with the ability to improve diagnostic accuracy and increase workflow efficiency, quality of care, and health outcomes for patients.

Melior ESG Assessment

We also consider AI ESG considerations as part of our ESG assessment (step 2 of our investment process). The insights we gain in our ESG assessments are leveraged to identify material AI ESG risks and opportunities that we engage with companies on to help drive sustainable returns. An example of this is Melior actively advocating for Next DC (NXT) outlined above to reduce their emissions intensity, expand their net zero commitments and ensure they have a resilient cybersecurity strategy in place.

Sources

1 How Businesses Are Using Artificial Intelligence In 2024 – Forbes Advisor

2 Artificial Intelligence – What is it and Why Does it Matter? (nvidia.com)

3 IBM Research: https://research.ibm.com/blog/what-is-generative-AI

4 Alan Turing (1950), COMPUTING MACHINERY AND INTELLIGENCE, I.—COMPUTING MACHINERY AND INTELLIGENCE | Mind | Oxford Academic (oup.com)

5 Large language models (LLMs) are a category of foundation models trained on immense amounts of data making them capable of understanding and generating natural language and other types of content to perform a wide range of tasks. – IBM What Are Large Language Models (LLMs)? | IBM

6 A.I. Could Soon Need as Much Electricity as an Entire Country – The New York Times (nytimes.com)

7 AI is poised to drive 160% increase in data center power demand (goldmansachs.com)

8 Data-Centres-and-Power-2013.pdf

9 How much will hungry data centres take out of the power grid? (afr.com)

10 Morgan Stanley, 2024, Exploring the upside potential and risks for NEXTDC, Goodman, power, and resources

11 Amazon Scraps Secret AI Recruiting Engine that Showed Biases Against Women” Roberto Iriondo, DataDrivenInvestor October 2018

12 Australia’s AI Ethics Principles | Australia’s Artificial Intelligence Ethics Framework | Department of Industry Science and Resources

This Report is issued by The Trust Company (RE Services) Limited (ABN 45 003 278 831, AFSL No. 235150) as Responsible Entity and issuer of units in the Melior Australian Impact Fund, based on information prepared and collated by Melior Investment Management Pty Limited (Melior). Melior is a Corporate Authorised Representative (No. 001274055) of Adamantem Capital Pty Limited (ACN 614 857 037, AFSL No. 492717). It is general information only and is not intended to provide you with financial advice, and has been prepared without taking into account your objectives, financial situation or needs. You should consider the product disclosure statement (PDS), prior to making any investment decisions. The PDS and target market determination (TMD) can be obtained by calling +61 2 9004 6071 or visiting our website www. meliorim.com.au. If you require financial advice that takes into account your personal objectives, financial situation or needs, you should consult your licensed or authorised financial adviser. To the extent permitted by law, no liability is accepted for any loss or damage as a result of any reliance on this information. No company in the Perpetual Group (Perpetual Limited ABN 86 000 431 827 and its subsidiaries) guarantees the performance of any fund or the return of an investor’s capital. Total returns shown for the Fund have been calculated using exit prices after taking into account all ongoing fees and assuming reinvestment of distributions. No allowance has been made for taxation. Past performance is not indicative of future performance. Listed equities markets can experience volatility, particularly in the short term. Investments in listed equities markets are therefore generally classified as higher risk than other asset classes such as fixed income and cash. As the Fund invests most of its assets in Australian listed equities, it should be considered a high risk investment. Please refer to the PDS for details of the types of risks which are associated with investing in the Fund.